Are Solar Renewable Energy Credits Taxable

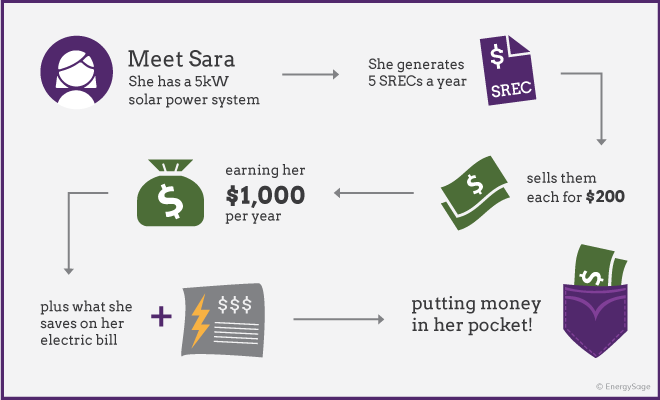

Solar Renewable Energy Credits SREC are credits that are minted when a solar energy system generates 1000 kilowatt hours kWh or 1 megawatt hour MWh of electricity. Are credits or payments you receive for power generated by solar panels assessable against pensions.

Financial Incentives For Installing Solar A Beginner S Guide Aurora Solar

A renewable energy certificate or REC pronounced.

Are solar renewable energy credits taxable. The market certainty provided by a long-term investment tax credit ITC for solar energy has supported private investment in manufacturing and project construction a vital part in meeting our nations energy policy goals driving cost-cutting innovation and job growth. All other solar energy systems such as photovoltaic systems must meet the new total output. The Residential Solar System will generate electricity for Taxpayers residence.

Taxpayer is a participant in Public Utilitys renewable energy incentive program whereby Taxpayer has agreed to transfer title and ownership of any environmental credits benefits emissions reductions offsets. If you have Non-employee compensation Box 7 of a 1099-MISC according to the IRS it is considered income from self-employment. RECs are issued when one megawatt-hour MWh of electricity is generated and delivered to the electricity grid from a.

Renewable Energy Technologies Income Tax Credit RETITC HRS 235-125. The purpose of this article is to provide a brief overview of the taxability of SREC income for both commercial and individual. The current federal solar tax credit guidelines were extended through 2022 when former President Donald Trump signed the Consolidated Appropriations.

You are considered to have a self-employed business and you are the owner. Are Solar Renewable Energy Credits Taxable. Schools businesses and communities all around the world can benefit from Solar energy.

These credits exist as part of state Renewable Portfolio Standards. By Karin Price MuellerThe Star-Ledger. Updated Apr 01 2019.

The solar investment tax credit was established by the Energy Policy Act of 2005 which established standards for renewable fuels mandated an increase in the use of. The solar investment tax credit ITC is a tax credit that can be claimed on federal corporate income taxes for 30 of the cost of a solar photovoltaic PV system that is placed in service during the tax year1 Other types of renewable energy are also eligible for the ITC but are beyond the scope of. The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance.

Many people who sell electricity from their solar panels receive a 1099 from the power company. Most renewable energy property is depreciated over 5 years using the 200 declining balance method shifting to straight line the half -year convention and a zero salvage value the percentages are 20 32 192 1152 1152 and 576 Basis for depreciation is reduced by half of the ITC or Grant so basis is 85 of cost. Is a Solar Photovoltaic Rebate taxable income.

There are many forms of renewable energy including solar energy fuel cells wind turbines geothermal systems and microturbines. Ad Join The Sun Exchange today. To put this unit into perspective 1MWh of electricity is roughly equal to 1 light bulb left on for 6 months.

Posted Dec 22 2009. Rěk is a market-based instrument that represents the property rights to the environmental social and other non-power attributes of renewable electricity generation. Others such as Woolf at Advanced Energy Economy believe developers will find other places to cut costs to avoid raising their prices.

The tax laws preservation of policies that provide for a gradual phase-out of wind tax credits through 2019 and a decline of solar tax credits through 2021 will help both industries prosper according to the American Wind Energy Association and the Solar. Solar Renewable Energy Credits income is not exempt from tax laws. Ad Join The Sun Exchange today.

Schools businesses and communities all around the world can benefit from Solar energy. Solar Rebates Feed in Tarriff Revenue CES. What is the federal solar tax credit.

On this page you will find information and documents pertaining to the Renewable Energy Technologies Income Tax Credit RETITC provided under 235-125 Hawaii Revised Statutes. Many states offer tax-exempt grants to help taxpayers finance the costs including installation of renewable energy systems. There has been much recent discussion on solar and energy blogs and in other discussion forums relating to the tax treatment of Solar Renewable Energy Certificate SREC income.

Srecs Understanding Solar Renewable Energy Credits Energysage

Superpowers Of Solar A Solar Energy Facts Infographic Solar Energy Facts Solar Energy Geothermal Energy

Renewable Energy Powerpoint Template Slidemodel Solar Energy Energy Resources Geothermal Energy

Srecs Understanding Solar Renewable Energy Credits Energysage